For the latter case, bullish options activity may be less meaningful than the exposure a large investor has on their short position in common stock. The activity is suggestive of these strategies, but an observer cannot be sure if a bettor is playing the contract outright or if the options bettor is hedging a large underlying position in common stock. These observations are made without knowing the investor's true intent by purchasing these options contracts.

Options are "bearish" when a call is sold at/near bid price or a put is bought at/near ask price. Options are "bullish" when a call is purchased at/near ask price or a put is sold at/near bid price. See also: How to Buy NVIDIA Stock Bullish And Bearish Sentiments Buyers and sellers try to take advantage of a large profit margin in these instances because they are expecting the value of the underlying asset to change dramatically in the future. "Out of the money" occurs when the underlying price is under the strike price on a call option, or above the strike price on a put option. "Out of the money" contracts are unusual because they are purchased with a strike price far from the underlying asset price. It is important to consider time value because it represents the difference between the strike price and the value of the underlying asset. Additional time until a contract expires generally increases the potential for it to grow its time value and reach its strike price. A contract cannot be considered closed until there exists both a buyer and seller for it.Īnother indicator of unusual options activity is the trading of a contract with an expiration date in the distant future.

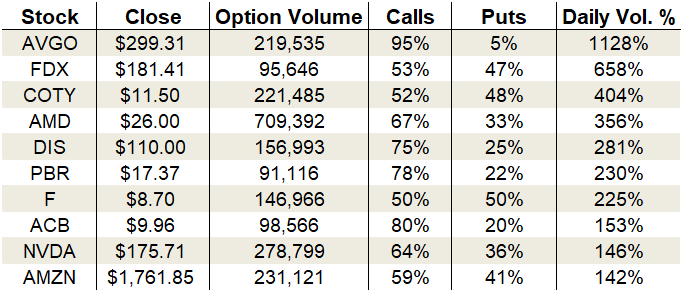

The number of contracts that have been traded, but not yet closed by either counterparty, is called open interest. The volume of options activity refers to the number of contracts traded over a given time period. One way options market activity can be considered unusual is when volume is exceptionally higher than its historical average.

0 kommentar(er)

0 kommentar(er)